Introduction

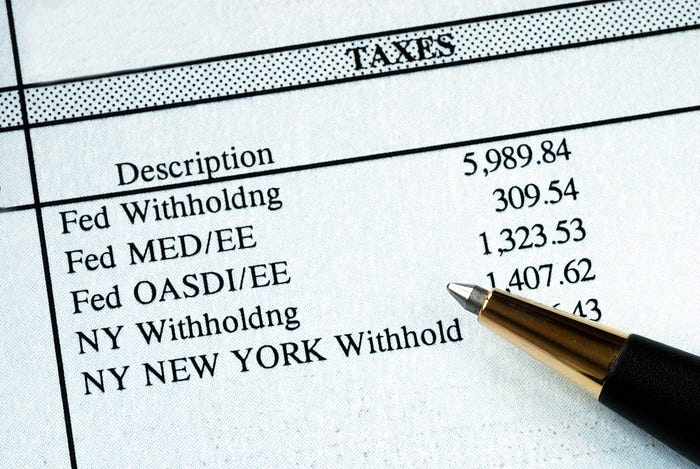

Ever felt like you’re drowning in tax letters and legal notices? Whether you’re running a small business or dealing with personal financial strain, getting hit with a sales tax audit lawyer new york or wage garnishment can be overwhelming. The good news? You’re not alone, and help is available.

This guide will walk you through the essentials — from understanding the sales tax audit process to finding a lawyer to stop garnishment. We’ll break it down in plain English and guide you toward the best legal help, including top New York Sales Tax attorneys and lawyers that handle garnishments.

Zoom image will be displayed

What Is a Sales Tax Audit?

A sales tax audit is when the government reviews your business records to make sure you’ve collected and paid the right amount of sales tax. It’s common for businesses in New York, especially those in retail, food service, or online sales.

Why You May Need a Sales Tax Audit Attorney

A new york state sales tax attorney understands both the laws and the nuances of how New York enforces them. They’re licensed, experienced, and deeply familiar with the state’s aggressive enforcement tactics — making them a key player in your defense.

Triggers for a New York Sales Tax Audit

The state may launch an audit for several reasons:

Inconsistent tax filings

Complaints from former employees or customers

Random selection

Discrepancies in reported sales or income

In any of these cases, hiring New York sales tax lawyer quickly is a smart move.

How Sales Tax Audit Lawyers Help During the Process

Sales tax audit lawyers review your financial records, prepare responses to tax authorities, and challenge any incorrect findings. They act as your shield and spokesperson when dealing with the state.

Hiring a Sales Tax Attorney New York Businesses Trust

The right sales tax attorney New York business owners depend on should:

Understand New York tax law

Have a history of audit defense success

Be transparent with fees and timelines

Don’t wait until you’re deep in trouble — start with legal guidance early.

Role of Sales Tax Litigation Lawyer New York Clients Rely On

If an audit turns into a dispute, a sales tax litigation lawyer New York residents rely on will take over. They represent you in court, appeal unfair assessments, and make legal arguments that can reduce or erase penalties.

Zoom image will be displayed

Support From a New York Sales Tax Law Firm

A reputable New York sales tax law firm provides full-scale support:

Helps prepare for audits

Negotiates with tax agents

Handles court representation if needed

These firms are a one-stop shop for your tax legal needs.

What to Expect From Sales Tax Attorney Near Me

Searching for a sales tax attorney near me? Expect prompt consultation, a tailored legal strategy, and clear instructions on how to protect your business from penalties and interest.

How to Avoid Red Flags That Lead to Audits

Want to stay off the radar of auditors?

File sales tax returns on time

Avoid underreporting income

Keep complete and organized sales records

Make sure you’re collecting sales tax on all taxable transactions

Still worried? Ask New York Sales Tax attorneys to review your process for peace of mind.

Why You Should Know the Best Tax Law Firms in New York

The best tax law firms in New York do more than defend — they prevent. They offer proactive audits, legal health checks, and real-time support when issues arise. Many businesses rely on them to stay compliant.

Facing Wage Garnishment? Here’s What to Do

Wage garnishment means your paycheck is being reduced because of unpaid debt. This often happens when taxes go unpaid or court judgments are made. It’s urgent to consult a lawyer to stop garnishment before your income takes a hit.

How Lawyers That Handle Garnishments Defend Your Income

Lawyers that handle garnishments will:

Review the validity of the garnishment order

Challenge it in court if it’s unfair or incorrect

Negotiate lower repayment or settlement terms

They help you regain financial control.

Finding a Lawyer to Stop Garnishment Quickly

Need a lawyer to stop garnishment fast? Time is of the essence. Reach out to a local attorney who understands the New York system and can act before your next paycheck is affected.

Why You Need Lawyers to Stop Wage Garnishment Immediately

Lawyers to stop wage garnishment are your last line of defense. They can file emergency motions, get court orders lifted, or restructure your payments. Every day you delay could mean lost income.

Zoom image will be displayed

Get a Tax Lawyer NYC Consultation Early

A tax lawyer NYC consultation helps you understand your rights and options. Whether you’re facing sales tax audits or garnishments, this first meeting can help you build a legal roadmap and prevent costly mistakes.

Conclusion

Sales tax audits and wage garnishments are tough situations, but you don’t have to face them alone. With the right sales tax audit attorney, experienced New York sales tax lawyers, and skilled lawyers to stop wage garnishment, you can regain control and protect what matters most — your income and your peace of mind.

FAQs

1. What does a sales tax audit attorney do?

A sales tax audit attorney defends your business during tax audits, ensures proper documentation, and negotiates penalties or settlements if needed.

2. Who are the best tax law firms in NYC for handling audits and garnishments?

The best tax law firms NYC provide full-service legal support for audits, wage garnishment, and tax disputes, often employing experts in both tax and litigation.

3. How can I find a sales tax attorney near me?

Search online, ask for referrals, and review client feedback. Make sure the sales tax attorney near me has experience with New York law and sales tax cases.

4. Can lawyers stop wage garnishment immediately?

Yes. Lawyers to stop wage garnishment can file emergency motions, negotiate debt settlements, and request court reviews to reduce or cancel garnishment.

5. What should I expect in a tax lawyer NYC consultation?

During a best tax lawyer nyc consultation, expect to review your situation, discuss legal options, and get clear next steps on how to resolve your audit or garnishment issue.

Write a comment ...