Introduction

Let’s face it — tax troubles are stressful. Whether you’ve skipped filing for years or your business is behind on payroll taxes, the IRS doesn’t play around. The fear of penalties, interest, or even criminal charges can keep you up at night. But here’s the truth: you don’t have to deal with this alone. A Top Unfiled & Payroll Tax Lawyer New York can help you fix the problem, protect your finances, and give you peace of mind.

This guide explains everything you need to know about tax defense and why having the right legal help makes all the difference.

Tax Trouble in NYC: You’re Not Alone

If you’re in tax trouble, you’re far from the only one. Thousands of New Yorkers find themselves facing unpaid taxes, wage garnishments, and IRS threats. It doesn’t mean you’re a criminal. Life is complex, and mistakes happen. But without action, things can get worse fast. That’s why working with a New York tax defense attorney is a smart move.

What Causes Unfiled Tax Returns?

You may think people avoid taxes on purpose, but most cases come down to fear, confusion, or life getting in the way. Common reasons include:

Changing jobs and forgetting to file.

Running a freelance or cash-based business.

Divorce or illness causing personal upheaval.

A unfiled tax returns lawyer New York helps bring order to the chaos, gathering your records and getting your filings up to date.

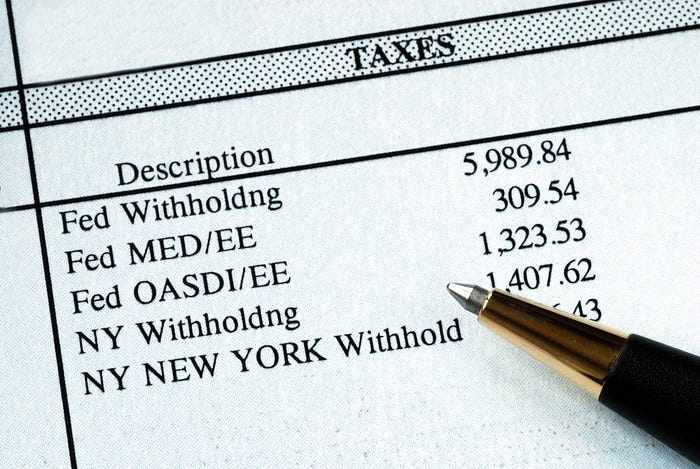

Payroll Tax Issues: What Every Business Must Know

If you own a business and fail to send payroll taxes to the IRS, you could be held personally liable. Yes — personally. Even if it was unintentional. The IRS treats payroll tax issues as extremely serious because you’re handling money withheld from employees.

A payroll tax lawyer New York knows the ins and outs of these laws and can defend your business before the IRS comes knocking harder.

Why Hire a Payroll Tax Lawyer New York

A payroll tax lawyer New York does more than read legal jargon — they actively protect your business from penalties, audits, and even shutdowns. They can:

Represent you in IRS hearings.

Negotiate settlements or installment agreements.

Help you avoid criminal liability.

When payroll taxes go unpaid, you need more than an accountant. You need a sharp legal advocate who knows the IRS’s playbook.

How an Unfiled Tax Returns Lawyer New York Helps

Haven’t filed in a few years? That’s okay — you’re not the first. A unfiled tax returns lawyer New York will review your income history, reconstruct financial records, and prepare all overdue returns. Best of all, they’ll help you avoid additional penalties by working out a plan with the IRS.

The Power of an Unfiled Tax Returns Attorney New York

The difference between a tax preparer and an unfiled tax returns attorney New York is legal protection. An attorney offers attorney-client privilege, which means what you share is confidential — critical if your case could involve audits or investigations. They also understand how to negotiate directly with the IRS and state tax departments to get you the best outcome.

When You Need a Criminal Tax Attorney NYC

Some tax cases cross the line from civil to criminal. If you’ve received a notice from a special agent, or if the IRS accuses you of fraud or evasion, it’s time to call a criminal tax attorney NYC immediately. Delaying could mean criminal charges, fines, or worse — prison.

These attorneys specialize in defending your rights, handling IRS interrogations, and resolving cases before charges are filed.

Services a New York Tax Defense Attorney Provides

A New York tax defense attorney doesn’t just help with taxes — they help with your peace of mind. Their services include:

IRS audits and appeals.

Offers in Compromise.

Tax litigation and settlements.

Wage garnishment defense.

Business tax resolution.

Think of them as your tax bodyguard, trained to fight the system on your behalf.

IRS Penalties That Can Ruin You

Here’s where penalties get real:

Failure to File: 5% monthly, up to 25% of the unpaid tax.

Failure to Pay: 0.5% monthly, also capped at 25%.

Payroll Tax Nonpayment: 100% penalty under the Trust Fund Recovery Penalty.

These penalties grow quickly. Hiring a Top Unfiled & Payroll Tax Lawyer New York early could mean the difference between recovery and ruin.

How to Choose the Top Unfiled & Payroll Tax Lawyer New York

You wouldn’t hire a foot doctor to do brain surgery — so don’t hire a general attorney for a serious tax issue. Look for:

Specialization in tax law.

Experience with both state and federal tax cases.

Clear communication and a history of client wins.

Proper licensing and recognition.

A great Top Unfiled & Payroll Tax Lawyer New York will have case results to prove their skill.

What Happens After You Hire a Tax Lawyer?

The first step is a consultation. Your lawyer will review your IRS letters, request financial info, and draft a defense strategy. They’ll handle communication with tax authorities and keep you informed at every stage. You’ll finally have someone on your side who knows how to talk to the IRS — and win.

How Much Does It Cost?

Hiring a payroll tax lawyer New York or unfiled tax returns attorney New York varies in price depending on your situation. Expect:

Hourly rates from $300–$600.

Flat fees for simpler filings or IRS responses.

Retainers for ongoing support.

Yes, it’s an investment — but the savings in penalties, interest, and legal protection can be life-changing.

Confidentiality and Legal Protection

Only a licensed criminal tax attorney NYC or New York tax defense attorney can offer you full confidentiality. That’s important if you’re being investigated or questioned by the IRS. Anything you say to an accountant or tax preparer could be subpoenaed — but not with your attorney.

Real Stories from Tax Defense Cases

One self-employed contractor hadn’t filed taxes in 7 years. With the help of a unfiled tax returns lawyer New York, he filed all past returns, avoided penalties, and paid a reduced amount over 24 months.

A small business owner in Brooklyn was behind on payroll taxes. A payroll tax lawyer New York worked out a settlement and saved her business from closure.

These are real situations — proof that legal help changes lives.

Final Thoughts: It’s Never Too Late to Get Help

Whether you’re years behind in filing, facing payroll tax problems, or staring down a possible criminal investigation, it’s never too late to fix it. But don’t try to handle it alone. A Top Unfiled & Payroll Tax Lawyer New York will help you move forward, rebuild your financial life, and sleep peacefully again.

Frequently Asked Questions (FAQs)

1. Can a payroll tax lawyer New York help if I owe multiple years of taxes?

Yes, they specialize in resolving multi-year tax debts and negotiating repayment plans or settlements.

2. What’s the difference between an unfiled tax returns lawyer New York and an unfiled tax returns attorney New York?

They’re the same, but “attorney” emphasizes legal qualifications. Both help resolve unfiled return issues legally and professionally.

3. When should I hire a criminal tax attorney NYC?

If you’ve received a criminal summons, are accused of fraud, or the IRS has started a criminal investigation — don’t wait.

4. Can a New York tax defense attorney stop wage garnishment?

Yes. They can negotiate with the IRS to remove or reduce garnishment and propose alternative solutions.

5. Will hiring a Top Unfiled & Payroll Tax Lawyer New York reduce my tax bill?

In many cases, yes. They may qualify you for a settlement, waiver, or other relief options that lower your liability.

Write a comment ...